In 2020, I argued that the hypercar industry was at a crossroads. Faced with increasing regulation, these machines would become faster and more capable but less engaging due to the weight of technology and the constraints of electrification. Now, several years later, it’s fascinating to observe how these predictions have unfolded – and where they’ve diverged.

The success of cars like the Gordon Murray T.50 is a testament to a countercurrent in the industry. The T.50, with its naturally aspirated V12, manual gearbox, and fan-assisted aerodynamics, epitomises what enthusiasts feared might be lost – lightweight, engaging, and utterly visceral performance cars. It’s a reminder that pure driver engagement is still possible when designers prioritise the essence of motoring over regulatory conformity. Similarly, Bugatti’s new Tourbillon, powered by a naturally aspirated V16 engine, doubles down on emotionality and spectacle. Even its interior focuses on craftsmanship and analogue mechanicals.

The Ferrari F80 exemplifies these complexities, with its polarising styling and lukewarm market reception (in the main due to its V6 powertrain and unconventional aesthetics). Several LaSource clients are acquiring the F80 primarily to maintain their VIP status with Ferrari, ensuring access to future limited models, rather than from genuine enthusiasm for the car itself. This dynamic becomes even clearer when coupled with the likely non-coincidental rising values of naturally aspirated V12-powered models like the Ferrari SP3, suggesting a disconnect between manufacturer offerings and market desires.

That disconnect becomes even clearer with the emergence of outstanding restomod businesses. Companies like our friends at Thornley Kelham, which recently unveiled reimagined versions of the Jaguar XK, Porsche 356, and Porsche 911, exemplify the best of what restomods can achieve. By modernising classic icons with cutting-edge performance while retaining their lightweight ethos and mechanical charm, they’re filling a void left by hypercars increasingly dominated by regulation. These carefully crafted restomods offer what modern hypercars often cannot: an analogue driving experience free from the layers of digital intervention.

However, the broader restomod landscape presents a more complex picture. With the explosion of new builders entering the market, the field has become increasingly crowded: – it’s another day, another restomod. This proliferation raises important considerations about quality and safety standards. While established specialists maintain exceptional engineering standards, many newer entrants operate in a regulatory grey area. Though features like roll cages engineered to FIA design standards offer some protection, few restomods incorporate the comprehensive crash structures and safety systems found in modern homologated vehicles.

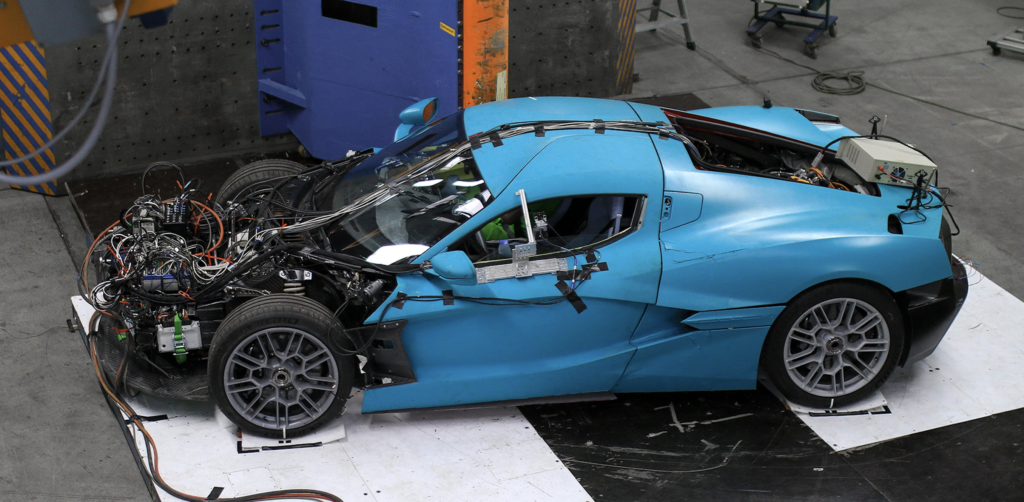

European Small Series Type approval is typically the go-to homologation process for limited production vehicles and is used by the likes of Koenigsegg, Pagani, GMA and the like. This slimmed down set of standards still requires a frontal impact test, as well as a side and rear impact ensuring a good level of safety. In the UK, the restomod industry is typically exploiting a points based system is used to ascertain the level of alteration. Changes to different areas of the car are docked points. Too much alteration will result in the vehicle being deemed as “radically altered”, requiring an Individual Vehicle Approval inspection. This inspection is very basic, and focuses on seat and seat belt anchorage design, interior design for impact, visibility and lighting, brakes etc. As parts of the restomod industry start to enter the hypercar space, and having worked on several OEM crash programmes during my engineering career at McLaren, I do worry that these regulations are becoming outdated.

For collectors considering restomods, the evaluation criteria must extend beyond mere aesthetics and performance, too. Critical factors include service support infrastructure, organizational stability, and long-term viability. The market will increasingly distinguish between professional operations with proper engineering resources and after-sales support, and those without such backing. Values will consolidate to reflect that in time, just as they have with the electrification of classics.

Once heralded as a potential growth area in the restomod world, electrified classics have faced significant headwinds. The collapse of Lunaz in 2024 demonstrates that while the technical process of electrifying classic cars is relatively straightforward, the market demand remains limited. Once again, authenticity and mechanical character still trump all else. A factor which affects all restomods – electric or otherwise – is the underlying cost of the restoration element. To electrify a classic to a sympathetic level of electrical performance likely costs in the order of £65,000 and at that price point there would be a viable market, but the cost to bring the underlying car up to a standard worthy of the “modifier’s” badge is not only hard to predict from car to car, but potentially eye wateringly expensive too. Between this, and the cooling of enthusiasm for a net-zero world I struggle to see a great deal of opportunity in the mid and upper tier markets for the foreseeable future.

In my 2020 piece, I proposed a ‘four-way stop’ for performance car manufacturers: embrace hybrid and EV technology, explore restomods, electrify classics, or diversify their offerings altogether. Looking back, it’s clear that while regulation has pushed hypercars toward heavier, electrified futures, the market hasn’t uniformly followed. The winners in this landscape will be those who manage to combine regulatory compliance with authentic driving engagement — or those who can demonstrate genuine engineering excellence and sustainable business models in the restomod space.

RML Group, whom we’ve recently agreed to represent, is a good example of a business doing things well. From ‘white label’ engineering firm into car manufacturer they initially launched the Short Wheel Base, and more recently – and in my eyes more excitingly – the P39; a Le Mans GT-inspired hypercar based on an unmolested 992 Turbo S chassis. Their OEM background provides a crucial distinction in the increasingly crowded bespoke space. Having engineered and built vehicles for numerous major manufacturers, RML brings genuine OEM-level safety standards and quality control to their own branded projects. This heritage ensures their cars aren’t merely aesthetic exercises but thoroughly developed performance machines with proper crash structures and safety systems that many competitors simply cannot match.

Likewise, Singer Vehicle Design continue to impress. As pioneers of the restomod industry they have lived the — at times painful – evolution from Garagista manufacturer to volume manufacturer. In recent years they have heavily invested in their engineering integrity and are designing and engineering cars to the levels one expects from an OEM. They will undoubtedly be one of the winners of the consolidation that I predict.

The hypercar industry now exists in a bifurcated state. On one side are the regulation-heavy, tech-laden machines that push the limits of physics but struggle to find enthusiastic buyers. On the other are the lightweight, driver-focused OEM cars and carefully selected restomods that celebrate purity over progress. Success in this market requires more than just technical excellence – it demands a deep understanding of what truly matters to discerning collectors.

As the hypercar market evolves, it’s clear that passion and engagement remain the ultimate benchmarks. Whether in a naturally aspirated V12 or a thoughtfully engineered restomod, the soul of driving endures, even as governments, think tanks and policy makers try to quash it.